Wednesday, October 28, 2009

Go Big (Mobile) or Go Home

One of the great things about owning an iPhone is all of the apps. If you're not an iPhone owner than you have no clue as to what I'm talking about. If you are an iPhone user you'll agree that you can find applications for nearly everything. So why am I ranting about the iPhone? It's fairly evident with Google's new Android OS and Palm, Windows Mobile, Blackberry et cetera that things are moving to an increasingly mobile environment. My curiosity lies in how future iterations of accounting software will allow mobile access. Security issues aside (remember there was a time when computers were not to be trusted) and smart phones are simply very tiny very mobile computers. My vision of the future (which also includes the Phillies winning a second World Series ) sees a not too far off time when an accountant can leave the office and conduct all his business through mobile apps. Not necessarily having a full version of Quickbooks on your phone but rather an iteration that allows you to track everything while out of the office. I envision it as a workflow management system in the palm of your hand. Just imagine leaving your practice earlier because of an emergency knowing that several important tasks are still on your plate. You open up an application on your phone that gives you a list of pending tasks, notifications, and IM's from clients and staff. You open the app and switch your workflow so that all notifications are sent to one or more team members while you're out. Now of course you want to check up on those tasks while you're out. You'll also be able to view your practice's complete and pending assignments no matter where you are. Receive a notification from a client about a file? A few taps on the phone and it's immediately sent to a team member. With all the tools out there right now I can't see this application as being far off. I am slightly surprised that such an application doesn’t already exist. I think it's only a matter of time before we see accounting practices go completely mobile with their practice.

Monday, October 26, 2009

When will Accounting Technology catch up?

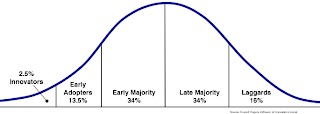

The Great Recession will greatly affect accounting technology over the next 4-5 years. With retirement portfolios taking big hits near retirement baby boomers have decided to hang on. Many in this demographic (I say many, not all) are late adopters of technology. As such it means that the move to newer technologies in most industries will slow down a little bit. Just two years ago, the stage was being set for a younger generation to start pushing new exciting technology very rapidly but that is going to slow down quite a bit. At the top of the page the Everett Rogers Technology Adoption Bell Curve gives us a great look at our different users in the accounting world. So who's using what in today's accounting tech world?

Innovators - The top 2.5 percent are our Cloud Computing and SaaS enthusiasts. They're probably using VOIP phones and texting their friends. If they're using Quickbooks they're already buying from the Intuit Marketplace. They have a website and they use it, the probably even know a little HTML. Twitter, Facebook and LinkedIn? Puh..lease! They've been dialed in for a long time. Windows 7 and Snow Leopard are already old hat.

The early adopters - In the same vein as the innovators but they're waiting for the bugs to get worked out. They're waiting on Windows 7 and some may still use Windows XP. They may have some information on the Cloud but they're more than likely doing it for cost savings and ease of use. They like being cutting edge but not to the point that systems fail. They're using Twitter and definitely have a website. They also have already updated to Quickbooks 2010. They're not as likely to be using VOIP phones as they're not entirely sure of the advantage but some do have them.

The early majority - They're using Quickbooks though probably just 2009. They have websites but aren't entirely dialed in to social media just yet. They're running Windows XP and as far as life goes there are no new big technology changes coming down the pike. They've heard of the Cloud but it looks dark and stormy to them. They may have social media accounts but it's mostly because some young college graduate insisted that they start one. Their first tweet was "trying to figure out how this works".

The late majority - Depending on the business there's a possibility they don't even have a website. Generally rely on word of mouth and the belief that they don't need to really advertise if they have a great product. They're using Windows XP and have software that's at least 2-3 years old and believe "if it ain't broke, don’t fix it".

The laggards - Our favorite pen and paper or even DOS users. Insisting that "it works for me!". Come on, everybody knows one. They're the AMC Pacer of software users. The late majority include a number of accounting professionals who due to the economic downturn will still be working for the next few years rather than opting for retirement.

So what does this mean overall for accounting technology? It means that things have slowed and will be that way for another few years. Don't expect the Cloud to take over anytime.

Monday, October 19, 2009

Accounting professionals as tech advisers

I've seen a couple good articles recently on the role of accounting professionals as technology advisers. I thought they made some very good points and wanted to highlight some things here. First off, it's very true that small businesses look to their bookkeeper or CPA for help with technology issues. If you're a certified Quickbooks Advisor you should be able to fix everything else right? By being able to fix those other issues you establish "stickiness" with your client. Your value as a trusted advisor simply goes up. So what do you need to be aware of to help provide the best technological advice to your client? I'm going to highlight a few big trends right now so that you can be an expert for your client.

1. Cloud Computing - Everyone's talking about moving to the Cloud even the Federal Government. Your Mom and Pop business however will have no idea what the Cloud is. So how do you explain it? In one sentence, your information lives on these servers over there and you can access them from everywhere. Simply put, it's not scary and it saves you money.

2. Security - This one goes hand in hand with Cloud Computing. The classic question, how do I know my e-mail, files, information et cetera is safe? You're going to confuse them when you say it's in a SAS 70 Type ii certified server. What's more dangerous to them are the links they click from phishing e-mails. Their data is safe on a SAS 70 particularly because it's not being moved from place to place on a CD or thumb drive. Make sure you warn them of the danger of phishing scams that come in the form of e-mails, text messages et cetera. If there's a link that you don't trust, don't click it.

3. Social Media - Get 'em signed up and get their brand out there. The least that it does it make you think of your business in a new dimension. The worst, you find it boring and don't want to do it anymore. Trying out Social Media won't hurt anyone.

4. Saas, PaaS and are two big acronyms floating around right now. What do they mean? SaaS - Software As A Service. It means software available for use online, that's it. It's used by the end user to access their software/data. PaaS - Platform As A Service - bundle up a bunch of SaaS apps on a platform and you've got you're PaaS. Expect some SaaS questions not so many PaaS questions.

5. Google - Know thy google information. Suggest it as a search engine. Seriously, some people still use what I'll call "unsophisticated" search engines. What's in a search engine? The algorithm.

I do realize that these are the very bare bone basics of what you need to know. Please feel free to comment below and help fill this post in a little more. I'm curious what clients are asking for of accounting professionals.

1. Cloud Computing - Everyone's talking about moving to the Cloud even the Federal Government. Your Mom and Pop business however will have no idea what the Cloud is. So how do you explain it? In one sentence, your information lives on these servers over there and you can access them from everywhere. Simply put, it's not scary and it saves you money.

2. Security - This one goes hand in hand with Cloud Computing. The classic question, how do I know my e-mail, files, information et cetera is safe? You're going to confuse them when you say it's in a SAS 70 Type ii certified server. What's more dangerous to them are the links they click from phishing e-mails. Their data is safe on a SAS 70 particularly because it's not being moved from place to place on a CD or thumb drive. Make sure you warn them of the danger of phishing scams that come in the form of e-mails, text messages et cetera. If there's a link that you don't trust, don't click it.

3. Social Media - Get 'em signed up and get their brand out there. The least that it does it make you think of your business in a new dimension. The worst, you find it boring and don't want to do it anymore. Trying out Social Media won't hurt anyone.

4. Saas, PaaS and are two big acronyms floating around right now. What do they mean? SaaS - Software As A Service. It means software available for use online, that's it. It's used by the end user to access their software/data. PaaS - Platform As A Service - bundle up a bunch of SaaS apps on a platform and you've got you're PaaS. Expect some SaaS questions not so many PaaS questions.

5. Google - Know thy google information. Suggest it as a search engine. Seriously, some people still use what I'll call "unsophisticated" search engines. What's in a search engine? The algorithm.

I do realize that these are the very bare bone basics of what you need to know. Please feel free to comment below and help fill this post in a little more. I'm curious what clients are asking for of accounting professionals.

Friday, October 16, 2009

What does SaaS and the Cloud mean to accounting professionals?

In my last blog I talked about why software companies are moving to the Cloud. In this blog post will talk about what it means to your business. Let's go through the pros and cons of moving to the cloud.

The pros -

1. Lower technology costs - No in house server will save you time and money. Additionally, no tech team to worry about.

2. Updated software - Your software when using SaaS and the Cloud is always up to date. Especially if you're using a hosted application you never have to worry about updating it.

3. Customization - This is coming but the ability to download applications to customize your SaaS software.

4. Safe and Secure Data - The data on the Cloud is much safer than in your office which is at risk for both environmental and break in damage. The servers supporting SaaS and data are also mirrored so that if something were to happen the facility would be back up in seconds.

The cons -

1. Unusable old software - Some of your old software that you enjoyed using is going to be rendered useless by updates. Either that or you'll have to pay to play. Need some tech support for your DOS application, fuggetaboutit.

2. Must have internet - All the cool applications that you download to interact with software? They won't work without a high speed internet connection. Same thing with SaaS and the Cloud in the first place. In other words, if you haven't…switch over from dial-up.

3. You're part of the wave of the future - Not that it's a con, but if you're not into being on the forefront then don't do it. There is something to be said for waiting for technology to be perfected before jumping in.

There you have it! The pros and cons of moving to Cloud Computing. In our next blog post will be discussing the time frame of adaptation of new technologies as it applies to our current conversation. In other words, how long will it be until SaaS technology becomes mainstream.

The pros -

1. Lower technology costs - No in house server will save you time and money. Additionally, no tech team to worry about.

2. Updated software - Your software when using SaaS and the Cloud is always up to date. Especially if you're using a hosted application you never have to worry about updating it.

3. Customization - This is coming but the ability to download applications to customize your SaaS software.

4. Safe and Secure Data - The data on the Cloud is much safer than in your office which is at risk for both environmental and break in damage. The servers supporting SaaS and data are also mirrored so that if something were to happen the facility would be back up in seconds.

The cons -

1. Unusable old software - Some of your old software that you enjoyed using is going to be rendered useless by updates. Either that or you'll have to pay to play. Need some tech support for your DOS application, fuggetaboutit.

2. Must have internet - All the cool applications that you download to interact with software? They won't work without a high speed internet connection. Same thing with SaaS and the Cloud in the first place. In other words, if you haven't…switch over from dial-up.

3. You're part of the wave of the future - Not that it's a con, but if you're not into being on the forefront then don't do it. There is something to be said for waiting for technology to be perfected before jumping in.

There you have it! The pros and cons of moving to Cloud Computing. In our next blog post will be discussing the time frame of adaptation of new technologies as it applies to our current conversation. In other words, how long will it be until SaaS technology becomes mainstream.

Wednesday, October 14, 2009

Quick video on how LinkedCPA's File Manager and how Team Member/Task Management works. http://bit.ly/3Teq63

7 Website Questions

The evolution of websites has been rapid over the past two decades. From AOL sites to Geocities having a website has become a necessity for many small businesses. Advertising on the web is like putting your billboard out on the highway. It needs to be up before anyone sees it. There are several companies that specialize specifically in CPA websites. The truth is that websites can be built and maintained for a lot less than you'll be charged through one of these. Companies that specialize in websites for CPA's take advantage of the fact that many CPA's don't know how much it actually costs to maintain or build a website. In most instances you're paying $600-$1200 a year for many services that are free or obtained for relatively low amounts while still remaining high in quality. Before you go buy a website ask yourself a few questions.

1. What do you want and need?

- You need to have a good idea of what your looking for in a website before you go shopping for your domain name and site.

2. Will the site be a brochure or will it be interactive?

- Will your site just contain information on who you are and what you offer? Do you want a site that's more interactive? Most accounting and bookkeeping professionals get excited about the idea of a very interactive site but really don't have a need for it.

3. What do clients want and need?

- Think of your current and potential clients. What would make their lives better? What will attract people to your firm after viewing your website? Think about this step carefully, who are you trying to attract?

4. What do you need on your site?

- Do you need e-commerce set-up i.e. a shopping cart, credit card processing, or any add-ons to your site? Generally CPA firms do not need these features. Their websites are simply advertising for their firm and making potential clients feel comfortable contacting them.

5. What is your budget for your website?

- Go in with a set amount in mind. Have an idea of what your expecting to spend in technology costs for your firm before you start. It's very easy to hire a programmer who decides to run wild with things you don't need or want.

6. Should I just hire the local kid or neighbor?

- It's very possible to get web design very cheap. The problem is that when something needs to be updated no one knows how or that person is very slow. Be very careful in making sure that choose a company that you can keep on retainer for a low price. Some companies will do 1 hour a month and allow you to roll over the hours each month. Basically allowing you to do updates a few times a year as need be. But ask yourself, how often do I update my advertising brochures? Websites don't need to be updated all the time if they're kept simple and concise. Which leads us to the next point, can you update it yourself?

7. Can I do it myself?

- A CMS or Content Management System allows you to do all website updating yourself. If you can type on Microsoft Word there's no doubt you can design your own website. Templates for designing a website can be found at www.godaddy.com (they also host your domain name) and even at Intuit http://www.intuit.com/website-building-software/. What many offices do is assign a member of their staff to be in charge of website updates. As long as the website is simple the problem is solved.

Remember that with a website you usually pay for what you get. If you're paying $60-$200 a month you should expect A LOT of service. If you're paying just for web hosting through godaddy.com you should expect to design your own website and not be paying someone else to do it. You should also expect the level of service to be commiserate with the amount of time you put into it.

Special Thanks to http://www.7designavenue.com for some of the information above.

1. What do you want and need?

- You need to have a good idea of what your looking for in a website before you go shopping for your domain name and site.

2. Will the site be a brochure or will it be interactive?

- Will your site just contain information on who you are and what you offer? Do you want a site that's more interactive? Most accounting and bookkeeping professionals get excited about the idea of a very interactive site but really don't have a need for it.

3. What do clients want and need?

- Think of your current and potential clients. What would make their lives better? What will attract people to your firm after viewing your website? Think about this step carefully, who are you trying to attract?

4. What do you need on your site?

- Do you need e-commerce set-up i.e. a shopping cart, credit card processing, or any add-ons to your site? Generally CPA firms do not need these features. Their websites are simply advertising for their firm and making potential clients feel comfortable contacting them.

5. What is your budget for your website?

- Go in with a set amount in mind. Have an idea of what your expecting to spend in technology costs for your firm before you start. It's very easy to hire a programmer who decides to run wild with things you don't need or want.

6. Should I just hire the local kid or neighbor?

- It's very possible to get web design very cheap. The problem is that when something needs to be updated no one knows how or that person is very slow. Be very careful in making sure that choose a company that you can keep on retainer for a low price. Some companies will do 1 hour a month and allow you to roll over the hours each month. Basically allowing you to do updates a few times a year as need be. But ask yourself, how often do I update my advertising brochures? Websites don't need to be updated all the time if they're kept simple and concise. Which leads us to the next point, can you update it yourself?

7. Can I do it myself?

- A CMS or Content Management System allows you to do all website updating yourself. If you can type on Microsoft Word there's no doubt you can design your own website. Templates for designing a website can be found at www.godaddy.com (they also host your domain name) and even at Intuit http://www.intuit.com/website-building-software/. What many offices do is assign a member of their staff to be in charge of website updates. As long as the website is simple the problem is solved.

Remember that with a website you usually pay for what you get. If you're paying $60-$200 a month you should expect A LOT of service. If you're paying just for web hosting through godaddy.com you should expect to design your own website and not be paying someone else to do it. You should also expect the level of service to be commiserate with the amount of time you put into it.

Special Thanks to http://www.7designavenue.com for some of the information above.

Monday, October 12, 2009

Why are we really moving to SaaS and Cloud Computing?

If you're an accountant interested in the latest in technology you've no doubt heard all of the hullaballoo surrounding SaaS and Cloud Computing. Why is their such a big stink about moving to the Cloud? The answer is really quite simple. Consider what a friend from Adobe recently told me, for every copy of Adobe CS4 sold in China there are 5 books purchased on how to use it. It's become too easy to find registration codes and have a pirated version of the software that you never paid for. This means that software companies are losing billions of dollars a year. In addition, if you buy a copy of software you really like and never want to upgrade to the next version the software company also loses. How is their value added for the software company? The revenue stream that helps fund development and innovation is gone. This means that software bought at the store is quickly going by the way side. Software in a box is a dead for software companies. The only real way to turn software back into a revenue generating tool is to move it to the web. Charge for the software OR allow free download/use through a browser. You're now paying for a subscription to the software and it does not reside on your actual desktop. Of course, the option to install on your desktop will be available but you won't have the full functionality of that piece of software. Now where's the value added? Here's where it gets really exciting. Software is going to end up being simple yet robust. What happens now is the option to "tweek" the software the way you want it. You can download various applications that will pull or import data from your application. (see my post from 10/8/09).

In our next blog we'll be talking about the pros and cons of SaaS and Cloud Computing.

In our next blog we'll be talking about the pros and cons of SaaS and Cloud Computing.

Thursday, October 8, 2009

Quickbooks 2010: The Rise of the IPP

With the release of Quickbooks 2010 a not so well kept secret is out. If you've already installed the program I'm sure you noticed the Intuit Marketplace. The Intuit Marketplace brings adynamic to Quickbooks that will result in a sea change for users. So what's the big deal?

Intuit has been quietly developing their Partner Platform and Federated App Engine for quite some time. I shouldn't say quietly, developers are well aware of what's been happening. Those who have not heard of it yet are the ones who are going to benefit the most. Here's why it's important, developers now have the ability to program in various languages and then launch through the Intuit Partner Platform.

Translated into CPA speak "it means that there's now a lot of people who can build things for exactly what you need". Soon you will design your own Quickbooks experience. The application marketplace is clearly aimed at building off the success of Salesforce's Force.com offering and with over 4 million users the market is ripe for the picking. Applications will be developed specifically for problems facing Quickbooks users everyday. Think of an issue and like the iPhone commercial Intuit will be able to say "hey, we've got an app for that". Unless of course you're looking for the "Making Clients Timely" app which has been under intense development but remains unfinished.

Right now the offerings on the Intuit Marketplace remain relatively meager but that's all going to change. In fact, I suspect that the entire Quickbooks UX (user experience) is about to change. It seems that Quickbooks 2010 is just a taste of what's to come. In another two years Quickbooks will probably be completely SaaS and literally customizable. Quickbooks will become an intensely personal experience i.e. you will download the apps and create your own Intuit experience. You have to admit that the potential here is pretty crazy. Developers are certainly excited but I have not seen much excitement from the Quickbooks community as of yet.

I think we need to give this one time as it's going to evolve as customer needs are met and realized.

Intuit has been quietly developing their Partner Platform and Federated App Engine for quite some time. I shouldn't say quietly, developers are well aware of what's been happening. Those who have not heard of it yet are the ones who are going to benefit the most. Here's why it's important, developers now have the ability to program in various languages and then launch through the Intuit Partner Platform.

Translated into CPA speak "it means that there's now a lot of people who can build things for exactly what you need". Soon you will design your own Quickbooks experience. The application marketplace is clearly aimed at building off the success of Salesforce's Force.com offering and with over 4 million users the market is ripe for the picking. Applications will be developed specifically for problems facing Quickbooks users everyday. Think of an issue and like the iPhone commercial Intuit will be able to say "hey, we've got an app for that". Unless of course you're looking for the "Making Clients Timely" app which has been under intense development but remains unfinished.

Right now the offerings on the Intuit Marketplace remain relatively meager but that's all going to change. In fact, I suspect that the entire Quickbooks UX (user experience) is about to change. It seems that Quickbooks 2010 is just a taste of what's to come. In another two years Quickbooks will probably be completely SaaS and literally customizable. Quickbooks will become an intensely personal experience i.e. you will download the apps and create your own Intuit experience. You have to admit that the potential here is pretty crazy. Developers are certainly excited but I have not seen much excitement from the Quickbooks community as of yet.

I think we need to give this one time as it's going to evolve as customer needs are met and realized.

Subscribe to:

Comments (Atom)